Institutional Bitcoin Yield Solutions

Conservative BTC Portfolio

The Conservative BTC Portfolio is designed for allocators who prioritise balance-sheet stability and low-volatility BTC-denominated rewards.

Balanced BTC Portfolio

The Balanced BTC Portfolio is structured for allocators seeking a higher reward profile while remaining within clearly defined risk limits. Both portfolios are multi-manager and multi-venue, built from numerous independent, low-correlated return streams across CeFi and DeFi venues.

Clients allocate BTC balances into segregated BTC Yield Portfolios via Coinchange infrastructure. Rewards accrue in BTC and remain variable over time — no outcome or level of yield is guaranteed.

Yield is derived from blockchain protocol incentives and a diversified set of CeFi and DeFi programs across CEX and DEX venues.

Our Portfolio Architecture

Multi-manager portfolio construction

BTC Yield Portfolios are constructed as multi-manager, multi-venue portfolios, combining independent trading programs and liquidity placements that are intentionally designed to be low-correlated for balanced yield.

Diversified non-correlated return streams

Each portfolio blends market-neutral and hedged return engines with calibrated directional components, aiming to reduce reliance on any single venue, protocol, or trading style.

Programmatic risk management

Coinchange’s risk engine monitors position health, venue concentration, protocol risk scores, and liquidity thresholds, continuously rebalancing the portfolios as conditions change.

Institutional-grade liquidity profile

Portfolios are designed with institutional liquidity in mind, targeting weekly liquidity windows and T+5 settlement under normal market conditions, with daily NAV and performance reporting.

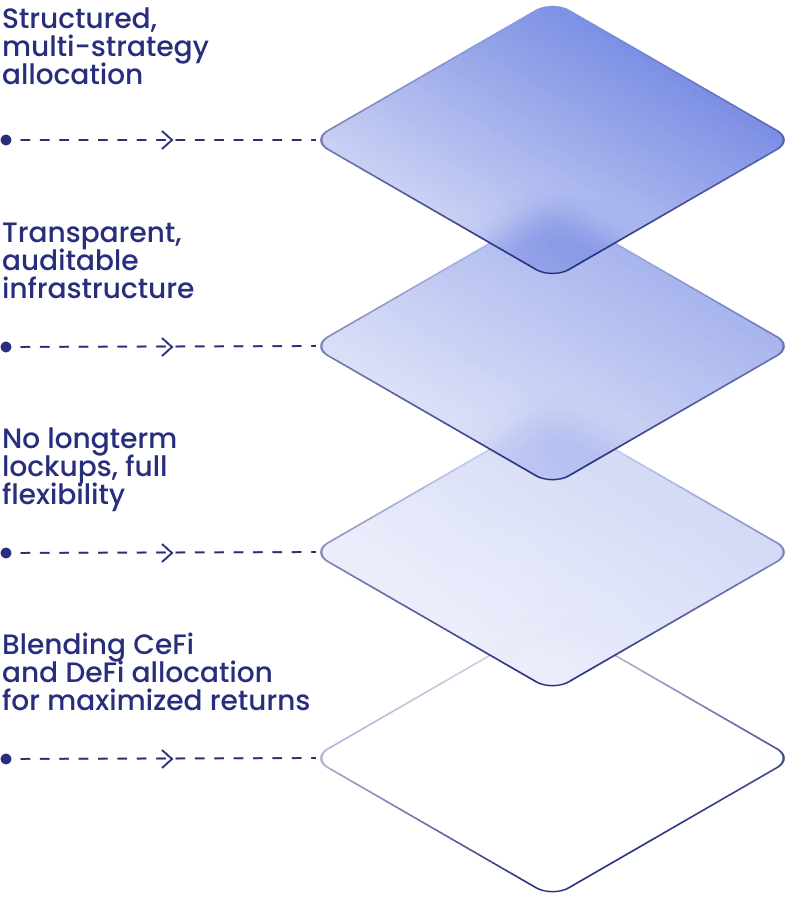

Blending CeFi and DeFi allocation for maximized returns

Diversification through delta-neutral and

hedged strategies

Weekly liquidity windows

Automated allocation, dynamic risk management and rebalancing

BTC Portfolio Allocations

Each portfolio is multi-manager and multi-strategy, engineered to reduce volatility and deliver non-correlated performance across changing markets. Allocations are professionally managed and dynamically rebalanced using our proprietary risk engine.

The table below shows target portfolio sleeves expressed by type of return engine (delta-neutral, market-neutral, low-risk directional, etc.). Actual portfolio composition varies over time based on market conditions, liquidity, and risk assessments. Allocations are professionally managed and dynamically rebalanced by Coinchange’s risk engine; no specific allocation, outcome, or level of yield is guaranteed.

Strategy Type

Conservative

Balanced

CeFi Delta Neutral

60%

45%

DeFi Market Neutral

25%

15%

Low-Risk Directional (hedged/no leverage)

15%

15%

Mid-Risk Directional Strategies

—

15%

High-Risk Directional Strategies

—

5%

Total

100%

100%

Blending CeFi and

DeFi allocation for

maximized returns

Weekly liquidity

windows

Automated allocation,

dynamic risk management

and rebalancing

Diversification through

delta-neutral and

hedged strategies

BTC Earn Portfolios

Conservative

The Conservative BTC Portfolio targets low volatility and BTC-denominated rewards with an emphasis on capital stability. It is built as a diversified, multi-manager portfolio predominantly composed of delta-neutral and market-neutral sleeves, with limited hedged directional exposure.

Balanced

The Balanced BTC Portfolio seeks higher BTC-denominated rewards within a clearly defined risk budget. It maintains a core of neutral portfolio sleeves, complemented by a larger share of calibrated directional sleeves, all within a multi-manager framework designed to keep individual return engines low-correlated to one another.

Infrastructure profile:

- Custody via institutional providers (e.g., Fireblocks\ Copper)

- Liquidity profile: T+5 settlement under normal market conditions

- Reporting: Daily NAV, portfolio composition and performance

- Denomination: Rewards accrued in BTC

- Design: Built for compliance, transparency, and scalable integration via API, UI, or smart contracts

Performance Metrics (Net of Fees)

Last updated November 2025

Metric

Conservative

Balanced

Target Yield (APY)

8.00%

12.00%

YTD APY (2025)

5.32%

4.40%

2024 APY

8.67%

15.38%

Cumulative Return (as of 2025)

14.45%

20.46%

Sharpe Ratio

4.00

2.58

Worst Month Return

-0.39%

-1.48%

Best Month Return

2.2%

3.78%

Avg. Recovery Time (Days)

2.5

3.2

Key Risks & Important Information

No guarantee of returns

BTC Yield Portfolios pursue BTC-denominated rewards by allocating across multiple trading programs and liquidity venues. Yield is variable and derived from blockchain protocol incentives and CeFi/DeFi, CEX/DEX portfolios; it may be materially higher or lower than historical figures and may be zero or negative over certain periods.

Market and volatility risk

Although portfolios emphasize neutral and hedged sleeves, they remain exposed to market dislocations, liquidity gaps, and execution risk, which can result in drawdowns.

Counterparty and protocol risk

Portfolios rely on third-party exchanges, custodians, and on-chain protocols. Failures, hacks, or defaults at these venues may lead to partial or total loss of assets.

Regulatory and jurisdictional risk

Access to digital-asset portfolios and the regulatory treatment of yield on digital assets differ by jurisdiction and may change over time.

Not a deposit or bank product

BTC Yield Portfolios are not bank accounts, are not deposits, and are not covered by deposit-insurance schemes (e.g., FDIC, SIPC or equivalents)

This information is intended for institutional and professional counterparties only and does not constitute a recommendation or an offer or solicitation to transact.