Crypto Digest: The Month of September 2023 in Review

DeFi TVL Updates

Key DeFi Stats for September:

In September, the TVL slightly increased in dollar terms from around $37.8B to $38.4B for the whole DeFi market. DEX 30day volumes have significantly dropped in dollar terms from $73B in May to $44.6B in August and now $35.2B in September. Stablecoin market cap stayed flat at ~$125B with the top two USDT ($83B) and USDC ($25B) accounting for about 85% of the total market cap.

Here are the rankings of decentralized finance (DeFi) projects based on Total Value Locked (TVL). TVL is a measure of the total assets locked in a DeFi protocol:

- Lido Finance has held the number one spot in terms of TVL since January of this year, surpassing the previous leader, MakerDAO. Lido Finance's TVL is approximately $14.1 billion.

- MakerDAO and AAVE have been competing for the second and third spots, each having a TVL close to $4.4 billion.

- Arbitrum Bridge is in fourth place with a TVL of $4.2 billion.

- Uniswap is in the fifth position with a TVL of around $3.1 billion.

Macro View

The State Of The US Economy

We looked at various economic indicators and their potential implications for the U.S. stock market and broader economy. Here’s a breakdown of the main points:

- Domestic Liquidity:

Liquidity indicators in the U.S. have been relatively flat. This means there hasn't been significant change in the availability of money supply in the economy.

- Stock Market vs Liquidity:

The U.S. stock market has deviated from its usual correlation with liquidity, meaning that even though liquidity is flat, the stock market isn’t necessarily following suit. However, we anticipate challenges for equity performance in the next six months due to various headwinds.

- Global Liquidity and Dollar Index:

Global liquidity, particularly in dollar terms, has been stagnating, which can impact international trade and investment. The Dollar Index has been rising, which is generally negative for global liquidity as the dollar forms a significant portion of global debt.

- Inflation and CPI:

The Consumer Price Index (CPI) continues to rise, signaling inflation. While Core CPI (excluding food and energy) remains above 4%, it’s falling, indicating some parts of inflation are cooling off.

- Diesel Prices:

Diesel prices are increasing, which can affect the cost of transporting goods across the country. This can contribute to inflation, and if it continues, it might influence the Federal Reserve to maintain a tighter monetary policy.

- Federal Reserve and Reverse Repo Facility:

The Fed’s reverse repo facility, which acts as a “battery” of liquidity was filled up following the stimulus efforts in 2020/2021 and is now being drained by the issuance of Treasury bills (T-bills). As it is drained, it injects liquidity back into the financial system, partially offsetting the Fed’s quantitative tightening.

The draining of this facility and the Fed's other actions have kept small and medium banks at stable cash levels relative to their assets.

- Interest Rates and Asset Performance:

Interest rates are high, contributing to mixed inflation signals. If the current trends continue, the it may put downward pressure on risk assets or result in more volatile market conditions.

Regulations Update

FASB says Crypto Assets Ought to be Valued at Present Market Rates

There has been a significant development in the accounting rules for cryptocurrencies in the United States. The Financial Accounting Standards Board (FASB), a standard-setting organization for accounting in the U.S., has taken steps to ensure companies use “fair-value” accounting for reporting their cryptocurrency holdings. The proposed changes represent a departure from the previous practice of marking digital assets for their unrealized losses. The industry viewed this old approach as a barrier to wider adoption of cryptocurrency. The new rules mean that companies will report gains and losses from cryptocurrencies as part of their quarterly income reports, which could lead to better transparency. This standard is planned to be effective for fiscal years starting after December 15, 2024, with the final language expected to be approved before the end of the current year. The FASB operates under the oversight of the U.S. Securities and Exchange Commission (SEC).

Gensler in Congress getting pushed around about Bitcoin spot ETF

Patrick McHenry, chair of the U.S. House Committee on Financial Services asked Gary Gensler about the regulatory classification of Bitcoin. Gensler asserted that Bitcoin is not a security as it does not meet the Howey Test. When suggested by McHenry that Bitcoin might be a commodity, Gensler sidestepped the assertion, indicating that the determination is beyond the SEC's purview. McHenry also levied accusations against Gensler, implying an attempt to hinder the digital asset sector and a lack of transparency concerning the SEC’s dealings with cryptocurrency exchange FTX and its former CEO, Sam Bankman-Fried.

Representative Warren Davidson criticized SEC Chairman Gary Gensler, accusing him of pushing a politically and socially "woke" agenda and misusing his authority. Davidson expressed a desire for the Biden administration to terminate Gensler's position and emphasized this sentiment with the phrase, "You’re fired." He and Representative Tom Emmer have introduced the SEC Stabilization Act, which he hints might facilitate Gensler’s dismissal.

There was a discussion between Representative Ritchie Torres and Gary Gensler, chairman of the U.S. Securities and Exchange Commission, regarding whether Pokemon trading cards, both physical and tokenized digital versions, should be classified as securities. Gensler hesitated to label a physical card as a security, while more information was needed to classify a tokenized card, emphasizing the Howey Test, which assesses the expectation of profits from others' efforts as a criterion for defining securities. Torres expressed frustration with Gensler's non-committal responses, labeling them as evasive.

Regulations is the friend of the incumbent, why crypto regulation will never prone innovation

Bill Gurley gave a presentation at the All-in conference in September talking about regulation and his experience with the effect it has on the market and innovation. The heart of the presentation revolved around regulatory capture. What is it? It's essentially the means by which corporations influence regulation to benefit themselves. What this leads to is personal interests (major corporations) benefiting at the expense of society. They do this by restricting the entry of new entrants and protecting prices or even making them increase; How do they do it? Through money, exposure, or revolving doors i.e.: political networking and recommendations.

Why should you care? The same is happening over in crypto. All market participants claim that “we need regulation for crypto to be adopted”, but this could really mean a concentration of power over a couple of companies restricting the way we access crypto. Evidence of that is all major exchanges chanting “We need regulations and we will push/lobby for it” but what they don’t tell is that such regulation will obviously favor them at the expense of new entrants hence leading to lack of competition thus harming the society.

Institutional Update

Circle Launches USDC On Multiple Chains Calling It #StableSeptember

Circle is on fire by launching Native USDC on the following chains:

- OP (Optimism Mainnet)

- Polkadot

- NEAR

- Polygon PoS

- Noble (Cosmos Ecosystem)

- BASE

This means that bridging USDC from one chain to the other won’t be required as Circle is using its internal Cross-Chain Transfer Protocol (CCTP) for this and it eliminates all 3rd party bridge-related hacks. Besides Coinchange is collaborating with Circle on a ‘Stablecoin Research Report’ which will be published in mid-October. Stay tuned!

BitGo and Swan Declare Intentions to Establish the First Bitcoin-Exclusive Trust Company in the USA

Addressing the growing demand for specific trust solutions for Bitcoin, BitGo and Swan Bitcoin have shared plans to start the first Bitcoin-only trust company in the USA. The partnership plans to combine BitGo's strong skills in custody and regulatory compliance with Swan Bitcoin’s skills in onboarding and fighting fraud. Aimed at providing unique solutions for Bitcoin in the areas of security and custody, this initiative is ready to create a strong alliance that blends the expertise of a well-known crypto custodian and a financial services firm skilled in Bitcoin transactions.

Spot Bitcoin ETF delays, ETH Futures ETF possibly opening next week

Valkyrie and Vaneck expected to start trading their ETH Futures ETF next week. This comes on the back of further delay of Spot Bitcoin ETF by the SEC. The SEC delayed Ark Invest’s ETF application for the second time. It seems like like they will delay individual applications and approve all at once, only time will tell.

Capital Raises in September

- Story Protocol raised $54M in a round led by a16zcrypto. They are building an infrastructure for storytelling creators enabling them to build imaginary worlds and narrative universes, allowing for a modular type storytelling that can be remixed and combined in various ways. Previously in May 2023 they raised $29.3M for their seed round.

- Proof of Play raised $33M in a round also led by a16zcrypto. They are a technology company focused on building on-chain games with true asset ownership.

- Bastian raised $25M in a round led by … You guessed it … a16zcrypto! It aims to merge Web 2 and Web 3 technology in the payment, entertainment, shopping, and connectivity space. They also emphasize regulatory compliance.

- Mesh raised $22M in a round Not led by a16zcrypto but by MoneyForward. They aim to facilitate easy transfer and management of digital assets, making the transactions more secure, compliant and user-friendly by offering interoperability amongst different wallets. Last year in June they raised $10M.

- Mocaverse raised $20M from CMCC Global. This is a gamified metaverse project by Animoca Brands where users can play challenges, customize they Moca NFTs and participate in the governance process of the platform.

The first trend that we observe in September is that a16zcrypto has started deploying capital again with them leading three of the largest raises this month. Secondly, on-chain gaming seems to pick up with $53M being raised by gaming-based companies. Lastly, September saw only $154M raised by the top 5 companies as opposed to $465M in August and $214M in July.

Other Noteworthy News/Events in September

Stablecoin Overdose

As the digital economy evolves, stablecoins are garnering increasing attention for their potential to bridge the traditional financial system and the world of blockchain. In a series of recent developments, stablecoins have been making headlines, showcasing their expanding reach and varied applications:

- Coinbase Embraces PYUSD-USD

Coinbase announced the listing of PayPal's stablecoin, PYUSD-USD.

- Brian Armstrong’s Vision for Decentralized Stablecoins

Furthering the stablecoin narrative, Coinbase CEO Brian Armstrong has revealed his top 10 crypto ideas, urging developers to focus on the innovative concept of "flatcoin." This decentralized stablecoin aims to track inflation to preserve purchasing power and could be either backed by a diverse basket of assets or adopt an algorithmic approach to maintain stability.

- Num Finance Targets Remittances with Colombian Peso-Pegged Stablecoin

Stablecoin issuer Num Finance has launched a Colombian peso-pegged stablecoin on the Polygon network. This initiative targets the robust $10 billion remittances market, demonstrating the potential of stablecoins in streamlining cross-border transactions and financial inclusivity.

- Mercado Pago Brings USDC Payments to Chile

Expanding the stablecoin ecosystem in Latin America, digital payment platform Mercado Pago has introduced USDC payments for its customers in Chile.

- Insightful Takes on the Rise of Stablecoins

For those seeking deeper insights into the stablecoin phenomenon, several thought leaders have shared their perspectives. Brevan Howard’s Peter Johnson has penned an illuminating piece titled “The Relentless Rise of Stablecoins,” exploring the myriad use cases and the sustained growth of this digital asset class.

Coin Metrics has published an in-depth analysis, “Exploring Common Ownership Patterns Across Major Stablecoins on Ethereum” offering a closer look at ownership dynamics and the evolving landscape of stablecoins on the Ethereum network.

Coinchange is publishing a research report on ‘Stablecoins Landscape and the Remittance Use-case’ co-authored by Hedera, Stablecoin Standard, Unocoin, Myna, Glo-Dollar and Brale which will be published in less than two weeks!

On-Chain Metrics & Data

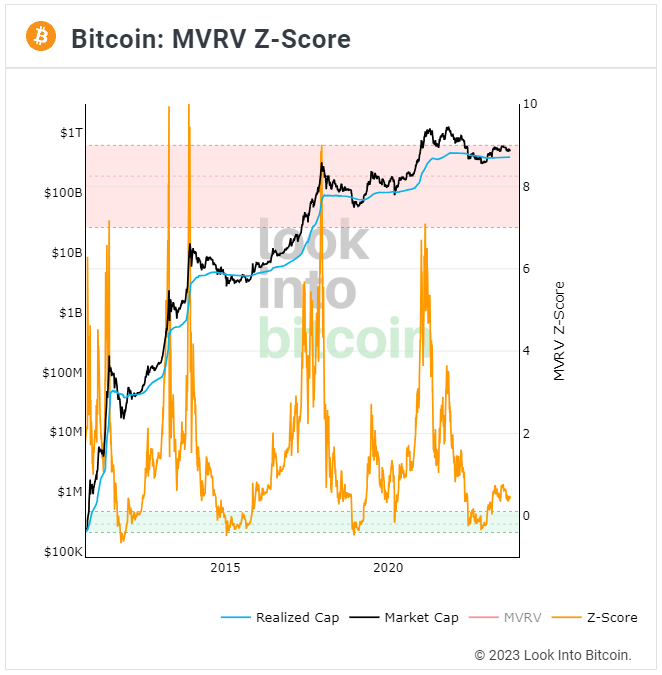

Bitcoin Update

Price update

There is not much activity in the price of bitcoin as it moved from $25.8k to $26.95. As usual, we recommend dollar-cost averaging as the best investment strategy for Bitcoin. That’s what Michael Saylor has been doing with his public company. MicroStrategy Bought 5,445 Bitcoin for $150M total last month at an average price of $27k. With that purchase, they now own approximately 158,245 BTC, acquired at an aggregate purchase price of $4.68 billion which comes to roughly $29,582 per bitcoin.

Historically bitcoin's strongest performance occurs in Q4 of the year, returning an average of 35% over the past nine years, with October returning an average of 20% in the past seven out of nine years. So our next months update might be slightly more positive than this one.

Ethereum update

The price of Ethereum stayed flat at ~$1650 for the entire month of September with very little volatility.

ETH supply has started going up, making it less deflationary than previous months. Below is a 30-day chart for the month of September from ultrasound.money.

Below is a zoomed-out 383-day chart (since the ETH merge):

On Sep 15, 365 days were passed since the monumental Ethereum Merge Event, marking a pivotal shift in the crypto space. In this duration, 700K ETH were issued, a staggering 1M ETH was burned, emphasizing the commitment to a deflationary mechanism, culminating in a net supply reduction of 300K ETH, an achievement that underscores the evolving ecosystem and its dedication to sustainability and scarcity.

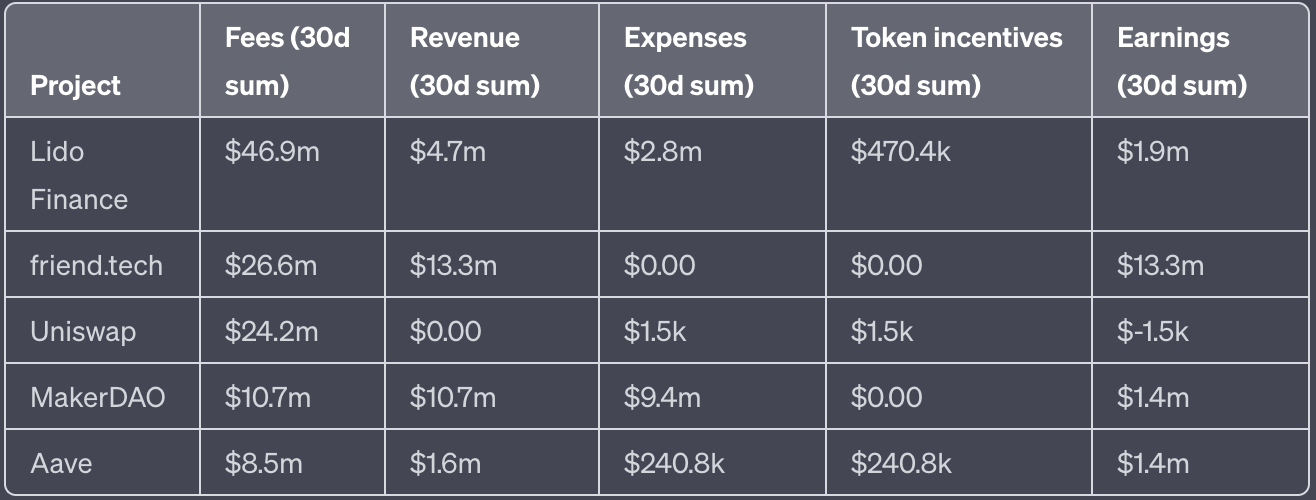

A look at the top DeFi protocols based on the fees generated

And finally let’s look at the top 5 DeFi/NFT protocols/ecosystems with the most fees generated over 30 days, which generally translates to the most active protocols. In some cases, the protocols take a % of the fee as revenues (eg. Lido Finance) in other cases its distributed almost entirely to the Liquidity Providers Stakeholders (eg. Uniswap Liquidity Providers) hence their revenue varies based on such parameters.

Here are the top 5 protocols for the month of September in terms of Fees generated:

Lido continues to occupy the #1 spot. Friend.tech generated an insane $26.6M in September (an increase from $11.2M in August) making it #2 (up from #4 in August). Uniswap got pushed to #3 as a result and MakerDAO which was #3 got pushed to #4 in September. And lastly, AAVE stuck to its #5 spot.

If you enjoyed this research report, please hit the smiling face, and if you want to earn passive income on your crypto, sign up for an Earn Account today!

Latest articles

Latest research papers

Stay informed - Subscribe today!

Receive monthly news and insights in your inbox. Don't miss out!