Launch Yield With flexibility

Embedded via API, UI, or

Smart Contrarct

No lockups, daily yield,

no infrastructure burden

Risk-managed yield, regulatory ready

Custodial and

non-custodial support

Custumizable Yield Solutions

LOW

RISK RETURN SPECTRUM

HIGH

Capital

Preservation

Market-Neutral

Stablecoin Lending

Balanced

Yield

Risk-adjusted DeFi/CeFi Blend

Enhanced Yield

Directional

Hedged Exposure

Alpha Strategies

Opportunity-driven

High APY potential

The multi manager multi

strategy advantage

Multi-Strategy

Yield Platform

At our core we operate like a hedge fund-of-funds, allocating capital across diverse strategies that are actively managed and risk-mitigated.

Institutional- Grade Returns

Get access to hedge fund-sophisticated strategies normally reserved for institutional investors. Get the benefit of risk managed yields with low volatility across diverse markets.

Daily

Accessibility

Yield-as-a-Service is a fintech native solution that abstracts institutional complexity into a daily yield product with no lockups, ho minimums, and no infrastructure burden.

Put Your Stablecoins to Work -

USDT and USDC Yield

Stablecoins represent over $130 billion in global circulating supply, yet the majority remain idle—sitting in wallets, exchanges, and payment platforms without generating value.

This untapped capital presents a massive opportunity for financial platforms and fintech operators.

Learn More

In emerging markets, stablecoins like USDC and USDT are essential for remittances, commerce, and savings—often used in place of unstable local currencies. Likewise, payment service providers and cross-border platforms rely on stablecoins for speed, transparency, and cost-efficiency.

Coinchange transforms this idle capital into productive infrastructure, enabling daily blockchain-based rewards through diversified, automated strategies—without long-term lockups or loss of control.

Talk to an Earn consultantPut Your Stablecoins to Work - USDT and USDC Yield

Stablecoins represent over $280 billion in global circulating supply as of 2025, yet the majority still sit idle in wallets, exchanges, and payment platforms — earning nothing for their holders. By 2030, that supply is projected to reach as high as $4 trillion under bullish adoption scenarios. This untapped capital presents a massive opportunity for financial platforms and fintech operators.

In emerging markets, stablecoins like USDC and USDT are essential for remittances, commerce, and savings—often used in place of unstable local currencies. Likewise, payment service providers and cross-border platforms rely on stablecoins for speed, transparency, and cost-efficiency.

Coinchange transforms this idle capital into productive infrastructure, enabling daily blockchain-based rewards through diversified, automated strategies—without long-term lockups or loss of control.

Risk/Return Spectrum Tiles

Capital Preservation

Portfolio focused on market-neutral stablecoin lending and delta-neutral portfolio sleeves, targeting low volatility and high liquidity.

Balanced Yield

Portfolio combining neutral and directional sleeves within a defined risk budget for higher reward potential and controlled drawdowns.

Enhanced Yield

Portfolio with a larger allocation to directional return engines with hedging overlays, for allocators with elevated risk tolerance.

Alpha- Oriented

Portfolio where opportunistic, higher-risk sleeves can be incorporated into custom mandates for clients pursuing higher APY potential within pre-agreed risk parameters.

The Multi-Manager Portfolio Advantage

Multi-Manager Yield Platform

At our core, Coinchange operates like a digital-asset multi-manager hedge fund, abstracted into infrastructure. Stablecoin Yield Portfolios allocate across multiple independent trading programs, venues, and liquidity pools that are managed and risk-scored centrally, with the aim of keeping individual return engines low-correlated.

Institutional-Grade Portfolio Construction

Access hedge-fund-grade portfolio construction — multi-manager, multi-venue, and multi-strategy, delivered through an API-first infrastructure. Partners benefit from diversified, risk-managed stablecoin portfolios that historically have exhibited low volatility relative to target APYs, while retaining full control of their user experience and economics.

Daily

Accessibility

Yield-as-a-Service is a fintech-native solution that abstracts institutional complexity into daily-priced portfolios with no long-term lockups, no infrastructure burden, and flexible sizing, suitable for both treasury management and end-user balances.

Put Your Stablecoins to Work – USDT and USDC Yield

Stablecoins represent over $280 billion in global circulating supply as of 2025, yet the majority still sit idle in wallets, exchanges, and payment platforms, generating no rewards for their holders. Under bullish adoption scenarios, that supply could scale into the trillions by 2030.

In many emerging markets, USDC and USDT are already core rails for remittances, commerce, and savings. Payment service providers and cross-border platforms rely on them for speed, transparency, and cost-efficiency.

The result is a set of multi-manager stablecoin portfolios that can be embedded directly into fintech apps, exchanges, and institutional workflows, enabling rewards on digital-asset balances without building a yield stack in-house.

Coinchange transforms this idle capital into programmable portfolio infrastructure.

Users or platforms allocate USDC/USDT into segregated Stablecoin Yield Portfolios; Coinchange’s engine then routes assets across multiple non-correlated portfolio sleeves, including institutional lenders, delta-neutral return engines, and tokenised fixed-income pools, while enforcing risk controls and concentration limits.

Why Coinchange Stablecoin Yield?

Coinchange provides a technology-powered DeFi and CeFi portfolio allocation allowing treasury teams, fintech platforms and exchanges to derive yield from stablecoin balances through a single risk managed platform.

Structured, multi- manager portfolios

Each Stablecoin Portfolio is built from multiple underlying portfolio sleeves (e.g., delta-neutral, market-neutral, directional, tokenised fixed income) that are designed to be low-correlated and managed under a central risk framework

No long-term lockups

Portfolios are designed around institutional liquidity needs, with T+5 redemptions under normal market conditions and daily NAV.

Transparent, auditable infrastructure

On-chain visibility, allocation reporting, and historical performance data support internal risk, compliance, and audit requirements.

Custodial and non-custodial options

Support for non-custodial vaults and institutional custodians so partners can align portfolio access with their existing operating model.

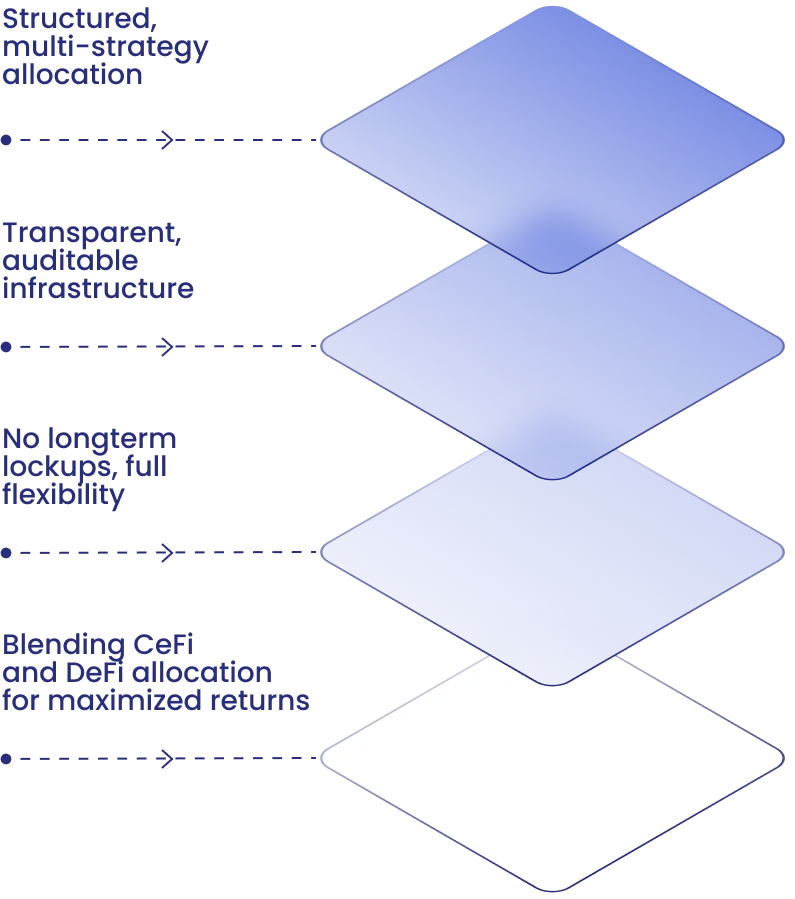

Structured, multi-strategy allocation

No longterm lockups, full flexibility

Transparent, auditable infrastructure

Blending CeFi and DeFi allocation for maximized risk/reward profile

Stablecoins Portfolio Allocations

Each Stablecoin Yield Portfolio is multi-manager and portfolio-driven, combining several independent portfolio sleeves that target different sources of stablecoin yield.

Metric

Conservative

Balanced

Aggressive

CeFi Delta Neutral

60%

35%

20%

DeFi Market Neutral

15%

25%

10%

CeFi Directional Hedged

25%

—

—

Low Risk Directional (hedged or no leverage)

—

30%

25%

Mid-Risk Directional

—

—

25%

High-Risk Directional

—

10%

20%

Blending CeFi and

DeFi allocation for

maximized returns

Weekly liquidity

windows

Automated allocation,

dynamic risk management

and rebalancing

Diversification through

delta-neutral and

hedged strategies

Stablecoins Earn Portfolios

Coinchange offers a range of stablecoin yield portfolios aligned to different institutional risk profiles, from low-volatility cash-management oriented portfolios to more return-seeking allocations. Custom portfolio mandates can also be configured for larger allocators.

Conservative

Profile: Low-volatility, liquidity-friendly rewards with an emphasis on capital stability

Portfolio design: Predominantly neutral portfolio sleeves (e.g., ~90% CeFi/DeFi delta-neutral) with limited hedged directional exposure.

Target APY: ~10% (variable and not guaranteed).

Historical statistics (as of last update): Sharpe ratio ~2.95; max monthly drawdown ~-1.8%.

Balanced

Profile: Higher reward potential with controlled drawdowns and a balanced mix of neutral and directional sleeves.

Portfolio design: Neutral sleeves reduced to ~60%, with increased allocation to low- and high-risk directional sleeves.

Target APY: ~15% (variable and not guaranteed).

Historical statistics (as of last update): Sharpe ratio ~3.50; max monthly drawdown ~-2.4%.

Aggresive

Profile: Return-seeking portfolio for allocators with a higher risk budget and tolerance for larger drawdowns.

Portfolio design: Directional sleeves become the majority (~70% directional, ~30% neutral).

Target APY: 25%+ (variable and not guaranteed).

Historical statistics (as of last update): Sharpe ratio ~3.17; max monthly drawdown ~-4.3%.

Portfolio infrastructure

Redemptions: T+5 under normal market conditions

Reporting: Daily NAV and portfolio-level performance

Custody: Prime exchange partners using institutional custody infrastructure

Risk profile: Portfolio selection aligned to each client’s desired reward profile and risk tolerance

All target APYs and statistics are performance objectives, not promises. Yield remains variable and is derived from blockchain protocol incentives and diversified CeFi/DeFi portfolio sleeves across CEX and DEX venues.

Performance Metrics (Net of Fees)

Last updated November 2025

Strategy Class

Conservative

Balanced

Aggressive

Target APY

10%

35%

15%

YTD APY (2025)

4.84%

4.35%

5.11%

2024 APY

16.89%

23.74%

33.44%

Cumulative Return (as of 2025)

21.1%

27.8%

37.4%

Sharpe Ratio

2.75

3.50

3.17

Max Monthly Drawdown

-1.8%

-2.4%

-4.3%

Avg. Drawdown

-0.36%

-----

-----

Avg. Recovery Time (Days)

3.6

-----

-----

Portfolio Summary

Stablecoin Low-Risk

Primarily delta-neutral: 90% of allocation in CeFi/DeFi Neutral.

Minimal directional exposure (10% CeFi hedged or non-leveraged).

Exceptionally stable profile with Target Yield of 10% APY.

Sharpe Ratio: 2.95, Max Drawdown: -1.8% monthly, Avg Drawdown: -0.36%.

Stablecoin Mid-Risk

Adds a significant directional component: 30% Low-Risk Directional and 10% High-Risk Directional.

Delta-neutral strategies reduced to 60% (35% CeFi + 25% DeFi).

Balanced approach producing a Target Yield of 15% APY.

Sharpe Ratio: 3.50, Max Drawdown: -2.4% monthly, Cumulative Return: 25.3%.

Stablecoin High-Risk

Directional-heavy: 70% exposure to Directional strategies (25% Low, 25% Mid, 20% High Risk).

Neutral strategies form only 30% of the portfolio (20% CeFi, 10% DeFi).

Built for maximum yield with a Target Yield of 25% APY.

Sharpe Ratio: 3.17, Max Drawdown: -4.3% monthly, Cumulative Return: 35.5%.

Portfolio Summary

Coinchange offers a range of yield strategies tailored to different institutional risk profiles — from stable, low-volatility cash management solutions to enhanced yield and high-alpha strategies. Customized portfolio strategies are also available.

Low-Risk Portfolio

is optimized for maximum stability and stablecoin target yield ~10% APY with the lowest drawdowns.

Mid-Risk Portfolio

offers a well-balanced blend of neutral and directional strategies, targeting 15% APY with managed volatility.

High-Risk Portfolio

is directionally aggressive, delivering a 25% APY target — suitable for allocators comfortable with higher volatility in pursuit of yield maximization.

Use Case

Conservative

Primarily delta-neutral: 90% of allocation in CeFi/DeFi Neutral.

Minimal directional exposure (10% CeFi hedged or non-leveraged).

Exceptionally stable profile with Target Yield of 10% APY.

Sharpe Ratio: 2.95, Max Drawdown: -1.8% monthly, Avg Drawdown: -0.36%.

Balanced

Adds a significant directional component: 30% Low-Risk Directional and 10% High-Risk Directional.

Delta-neutral strategies reduced to 60% (35% CeFi + 25% DeFi).

Balanced approach producing a Target Yield of 15% APY.

Sharpe Ratio: 3.50, Max Drawdown: -2.4% monthly, Cumulative Return: 25.3%.

Aggresive

Directional-heavy: 70% exposure to Directional strategies (25% Low, 25% Mid, 20% High Risk).

Neutral strategies form only 30% of the portfolio (20% CeFi, 10% DeFi).

Built for maximum yield with a Target Yield of 25% APY.

Sharpe Ratio: 3.17, Max Drawdown: -4.3% monthly, Cumulative Return: 35.5%.

Built for Stablecoin Holders

Structured, multi-strategy allocation

Transparent, auditable infrastructure

No longterm lockups, full flexibility

Product Characteristics

P&L Reporting: Daily NAV and performance updates

P&L Reporting: Daily NAV and performance updates

Redemptions: T+5

Custody: Prime exchange partners (Binance, OKX) using Ceffu or Fireblocks custody infrastructure

Product Characteristics